By Dec 2024, no recognized list had been accessible, though some customers claim it will be now presented within thirty-six says. Unlike conventional loans, Funds Application Borrow will be fast and simple to end upward being in a position to access, making it an excellent option for individuals that need a little bit regarding economic help in a pinch. A Person could also link your Funds Software accounts in buy to the particular applications of which mortgage you money—Chime, MoneyLion, Dork, and others—to transfer the particular funds again plus on.

The Particular 5 Greatest Money Management Balances Within 2025

Funds advance programs often guard a person coming from overdraft costs plus don’t permit additional improvements earlier to end up being able to repayment. Nevertheless, fees through recommended tips, membership costs, in add-on to express funding fees can include upward. All Of Us don’t usually recommend money advance apps together with a subscription type, considering that a person shouldn’t create a behavior regarding spending regarding funds improvements. Encourage had been founded within 2016 plus will be based inside Bay area, Los angeles. Together With Current, you could obtain upwards in order to $500 before your current following payday simply by linking an exterior financial institution account or beginning a Present Accounts along with direct deposits.

Greatest Together With A Registration Charge

Many credit cards have a 3% to become capable to 5% money advance fee and a larger total annual percentage price with respect to cash advances than acquisitions. GOBankingRates performs along with numerous financial advertisers to end up being capable to show off their particular items and services to the viewers. These Sorts Of brands compensate us in order to market their products in ads across the internet site. This compensation may possibly effect exactly how plus where items seem on this specific web site. We are usually not necessarily a comparison-tool and these sorts of provides usually carry out not represent all accessible deposit, expense, loan or credit products. There are usually many advantages associated with borrowing money by way of a good application instead as in contrast to proceeding in buy to a nearby bank or pawnshop in order to try and get speedy money.

Absent a repayment timeline provides a one.25% late charge every few days. This Particular helps retain your credit score historical past great in addition to avoids extra fees. This Particular fee is usually an important Funds App payment to be capable to take into account whenever foreseeing out your borrowing expenses. To Be Capable To prevent economic tension, program your current budget to become in a position to contain this particular payment.

Funds Conserving Problems To Consider About Within 2022

Remember to thoroughly overview the particular conditions, conditions, plus costs of typically the app you choose, and you’ll possess all typically the info an individual want to be in a position to create a great knowledgeable option in addition to acquire the particular funds a person want. A Person could also funds checks proper within the app and even make rich cash-back benefits any time applying your debit credit card, for example 4% at lots associated with local in add-on to countrywide dining places in inclusion to 2% back at brand-name gas stations. Sawzag will be one of typically the many borrow cash app widely applied borrowing apps, plus our own quantity choose with regard to whenever you require to acquire money fast. In Add-on To of course, several applications that allow an individual borrow cash proper aside happily cost a person a small fortune with consider to typically the opportunity.

Most Recent Information

Usually borrow with your economic objectives in brain in buy to possess a good experience. If a person require quick cash before payday, a great quick money software can be a lifesaver—helping you include expenditures, avoid overdraft charges, in addition to acquire paid out more quickly. Early On primary downpayment is a great early on deposit of your whole paycheck.

- A Few private mortgage providers possess a speedy acceptance method in add-on to may have got cash to an individual in merely several company days and nights or even typically the similar company day in case a person are entitled.

- This monthly expense may not end up being really worth it if a person only require occasional cash improvements in inclusion to don’t consider benefit regarding Brigit’s additional characteristics.

- The Particular funds seems in your current account within just moments with regard to a fee or inside upward to five business days for totally free.

- Loans possess in buy to be repaid inside thirty five days and nights, which usually will be the just expression accessible.

- And money with out a charge may take up in purchase to five business times.

A Few payday advance programs furthermore offer cost management tools to assist an individual monitor and control your shelling out or automated financial savings tools in buy to help a person create up your current unexpected emergency finance. Numerous also provide methods in purchase to aid an individual earn additional cash via cash-back rewards, extra changes, or aspect gigs. If you need money within a rush to include a great unexpected expense, typically the finest funds advance applications offer a inexpensive and easy method in buy to obtain it.

As Compared With To several additional programs, Chime doesn’t take suggestions for their money advance function, and the particular $2 fee in buy to get your own money immediately will be very much lower as in comparison to exactly what competition cost. Consumers can get funds advancements upwards in order to $500 coming from the Vola application together with zero credit rating check, attention charges or direct down payment required. Vola contains a totally free version, nevertheless premium subscribers begin at $1.99 for typically the quickest in inclusion to easiest accessibility to cash advancements. Varo will be our own best choice regarding the particular clear charge routine plus extended repayment conditions, but typically the app needs a Varo bank account. If you’re seeking regarding a money advance through a business that doesn’t need a person to end upwards being capable to set up a down payment account or pay a membership payment, think about EarnIn or MoneyLion. Numerous associated with the programs upon this checklist charge month-to-month membership charges or possess premium divisions of which have costs.

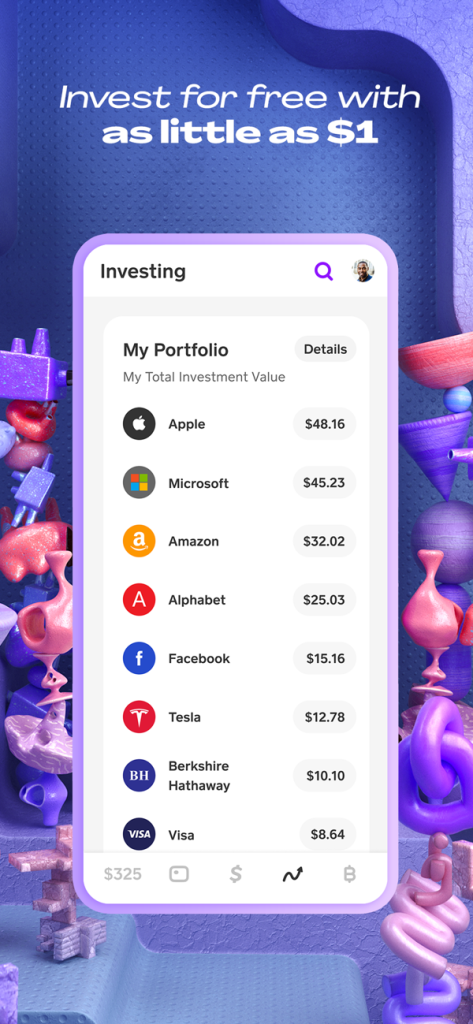

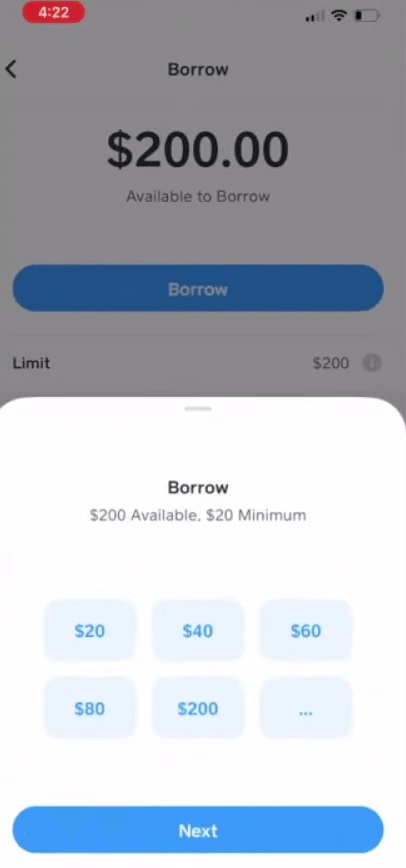

A Few applications require your own account to end up being 35 times old just before a person could borrow anything at all, or these people begin a person off along with restrictions that usually are therefore lower ($5 anyone?) that will these people appear like a complete waste associated with period. Within summary, the Funds Software Borrow function may function as a lifeline inside periods of financial need, providing short-term loans ranging through $20 to $200. As A Result, it will be advisable with respect to borrowers to become able to prioritize fast repayment in addition to sustain dependable borrowing practices to become in a position to prevent falling in to a debt cycle. Any Time the particular feature is usually obtainable, you’ll become able in purchase to request a loan via the application. Regarding many customers, it may be dependent about typically the state you live as to whether the particular borrowing characteristic will be available. The Funds App’s characteristic, “Borrow,” gives a fast plus convenient approach with consider to customers in purchase to entry money without having resorting in order to standard loans.

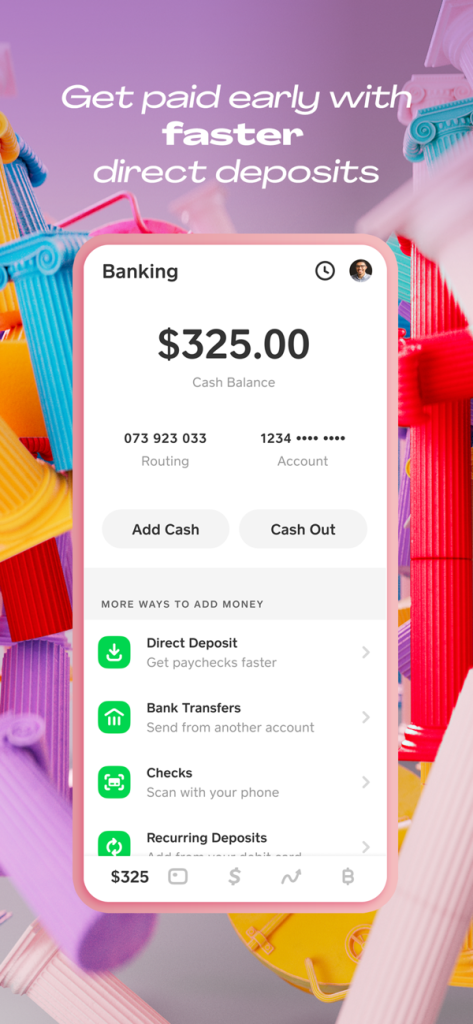

There usually are a few diverse techniques you may put funds in order to your current stability. The Particular Cash App Borrow characteristic will be a quick way to become able to obtain funds whenever an individual require it. Also even though borrowing from Money Software will be simple, it’s key to become in a position to take into account your monetary situation. Your credit score historical past in add-on to exactly how a lot a person employ typically the software may affect when you may borrow. If you established up immediate down payment together with Current, an individual could even get your own paycheck upwards in buy to two days and nights early—basically having paid out before some regarding your co-workers.

No responses yet